The HR department is typically responsible for managing employees leaves across different categories and creating accrual policies.

Accrual policies vary for each employees and depends on the factors such as years of service of the employee in the organization or designation. Apart from this there are many other factors and scenarios for which accrual policies are created.

Companies offer leaves to employees as part of their benefits. Employees get these leaves as credit for time worked.

For example, a company can give an employee 12 hours of sick time every month. If the employee does not use their sick leave for a particular month, the leave may accrue into an account to use later. There are various possibilities on how this time off accruals work such as:

-

Cashing out these leaves at the end of the year, if it is not used.

-

Only a certain number of leaves can be transferred to the following year.

-

Prorating accruals if the employee joins in the middle of the month and if the leave is accrued in the beginning or end of the month.

In this article, we have mentioned few accrual scenarios that will help the HR departments to create accrual policies easily and implement in their organizations.

You can also refer to the below given resources to get more detailed information on Accruals:

- A Guide to effectively utilizing Time Off Accruals

- Accruals: A Comprehensive Guide to Understanding Time Off

How OfficeClip can be used for specific accrual scenarios?

-

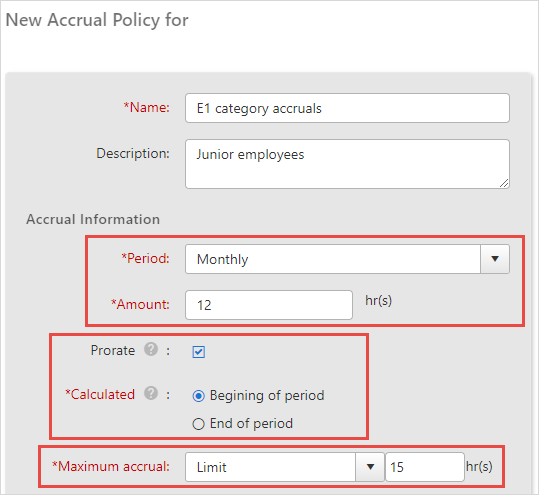

Accruals with a maximum limit

Your employees are allotted 12 days of casual leaves for a year. One leave per month, at the beginning of the month, and prorated. You can set the limit of accrual for your employees. This maximum accruals are different for every employee and may depend on years of service or designation of the employee.

-

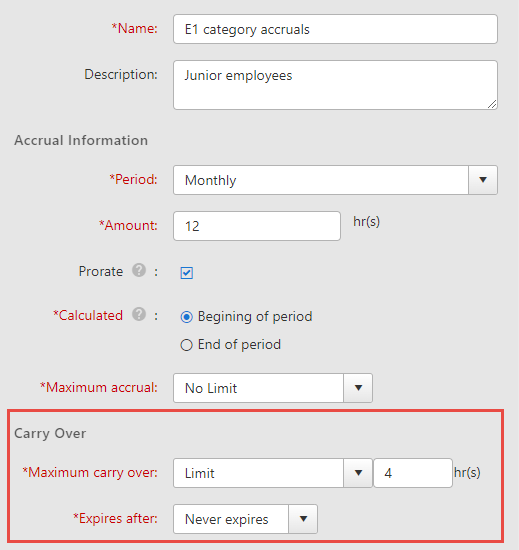

Accruals with maximum carry-over limit:

Your employees are allowed 12 days of casual leaves for a year. One leave per month, at the beginning of the month, and prorated.

You can set the limit of accrual carry-over for your employees. For example, suppose the employee uses only five casual leaves in a year, and the carry-over limit is only 4. In that case, the other three leaves will expire.

-

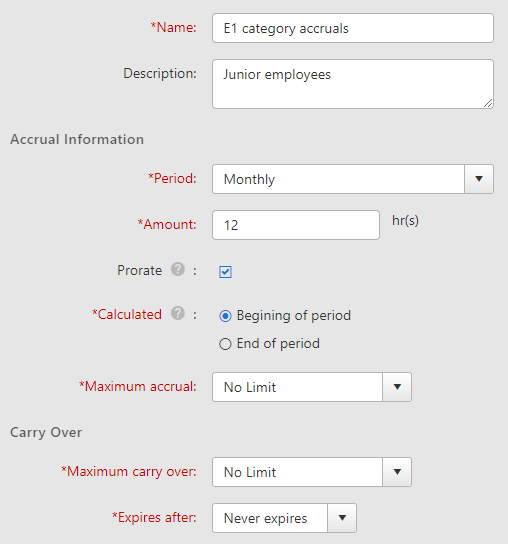

Accruals carry over without expiry date:

The Administrators can set the carry-over accruals to the Never Expires setting. Employees can use these accruals or encash those depending on the company policy.

-

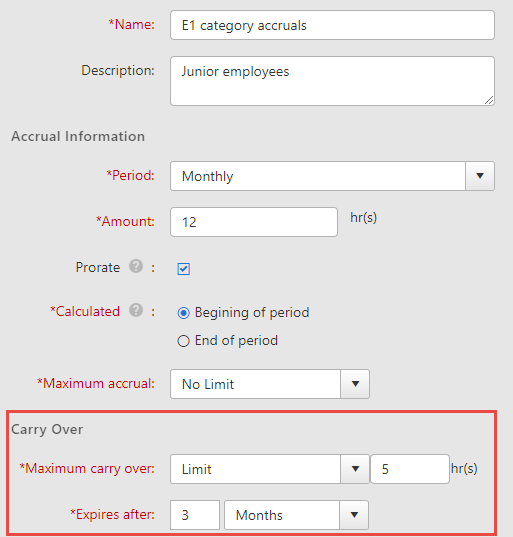

Accruals carry over with expiry date:

An employee can carry over their accruals as per the limit set. But the Administrators can set an expiry date also. So the employee needs to use these accruals within the given period, or they may expire.

-

Promotional accrual policy:

Jerry is allocated 12 days of casual leave for a year starting from 1st January. However, on 1st July, he got promoted and got 15 days of casual leaves. So from 1st July, his accrual policy will change, and he will get 1.25 days of casual leaves.

The Administrators can change the accrual policy for Jerry on 1st July with the same effective date. The accrual policy needs to be set on the same date as promotion, as the accrual policy for future dates cannot be set.

-

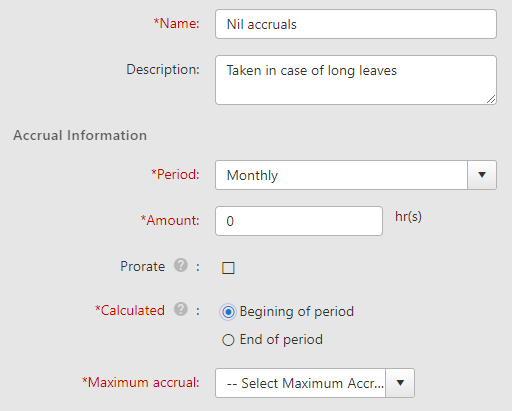

Accrual policy for an extended leave of absence:

Mary worked from 1st January to 30th June. She is taking a study leave of 6 months from 1st July to 31st December.

In this case, the Administrator can create a Nil accrual policy, where the amount should be 0. So from 1st July, the Administrator needs to change the accrual policy for Mary to Nil accruals.

And again, with effect from 1st January, the policy can be adjusted to the previous ones so that all the balance accruals till 30th June will automatically be carried over.

-

Prorated Accruals:

Let’s take a look at how prorated accruals work.

For example: Tim is allocated 24 days of casual leaves per year which is two leaves per month, starting from 1st Jan. Tim’s joining date is 16th Jan, and accruals are prorated. If Tim takes ten leaves in the year, his leave accruals for the year on 31st Dec will be:

23 days(since accruals are prorated, there will be one leave from 16th Jan to 31 st Jan) – 10 days = 13 days

Apart from these, you can also create more accrual policies as per your business requirement.

When designing time off and accrual policies, it is important to prioritize the well-being of employees. This will lead to a happier workforce that can achieve a better work-life balance and increased productivity.

Note: This blog has been published in 2018 and has been updated.

Deepa Kapoor is an online writer for small businesses. She loves to write on the advancements of new technologies and how it affects our lives. She always explores ways to make small businesses more profitable. When not writing, she enjoys reading books and cooking exotic traditional food.