What does Time-Off Accruals mean?

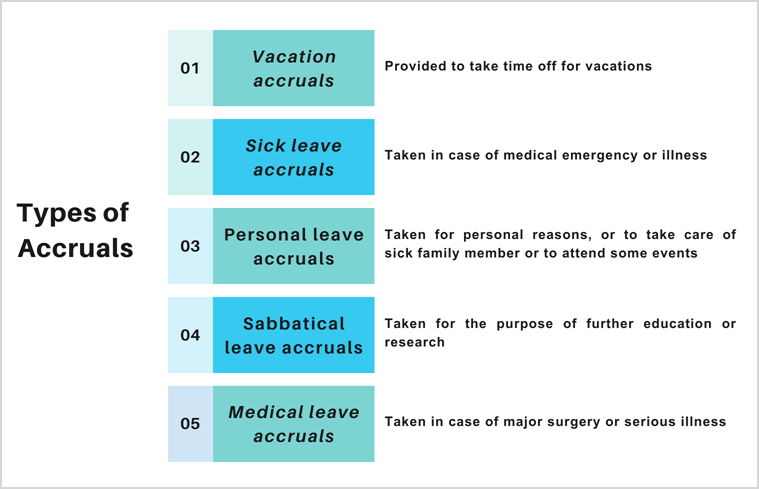

Accruals are credits for time off that companies give to employees. Employees earn accruals at a fixed rate per week or month. When an employee takes time off, they use up their accruals.

The amount of accruals an employee earns can vary depending on their seniority, with more senior employees typically earning more accruals.

Unused accruals can be carried over to the next year or compensated in cash. It is important to note that some companies may limit the number of leaves that can be carried over to the following year, as per their policies.

How to calculate Leave Accruals?

Calculating leave accrual accurately and efficiently is crucial for any organization managing employee time off. This calculations explores various accrual methods to help you choose the most effective approach for your company.

Employers first need to fix the accrual allowance in the number of hours/days for each employee. Then, they can decide what accrual to use – yearly, monthly, semi-monthly, weekly, daily, or hourly depending on the pay period.

Accrued time off calculations:

Yearly:

The yearly accrual allowance can be allotted at the beginning of the year or the employees’ work anniversary date. Whenever the employee takes a leave, subtract it from the current balance. The balance is carried forward to the next year or is compensated in cash, depending on the company policy.

For Example:

- If an employee gets 20 days of accrual in a year, they have used 12 of them.

- Then, at the end of the year, the accrual balance left is 20 days – 12 days = 8 days.

- These eight days can be rolled over to next year’s accruals or compensated.

Monthly:

- An employee is allotted 20 days or 160 hours(20 days X 8 hours) of accruals per year.

- Accruals earned per month = Divide the total accruals by number of months:

20 days / 12 months = 1.67 days per month or 13.36 hours per month.

Semi-Monthly:

- An employee is allotted 20 days or 160 hours(20 days X 8 hours) of accruals per year.

- Accruals earned semi-monthly = Divide the total accruals by number of months: 20 days / 24 months = 0.83 days per month or 6.67 hours per month.

Weekly:

- Total accruals = 20 days or 160 hours(20 days X 8 hours) per year

- Work weeks in a year = 52

- Accruals per week = 20 days / 52 weeks = 0.38 days per week or 3.08 hours per week

Daily:

- Total accruals = 20 days or 160 hours(20 days X 8 hours) per year

- Workdays in a year (minus holidays) = 250 days

- Accruals per day = 20 days / 250 days = 0.08 days per week or 1.92 hours per day

Hourly:

- Total accruals = 20 days or 160 hours(20 days X 8 hours) per year

- Working hours in a year = 2080 hours

- Accruals = 160 hours / 2080 hours = 0.07 hours for each hour

Additional points to consider while calculating accruals:

- Rounding: Determine company policy on rounding accruals (up, down, or nearest increment).

- Part-time employees: Adjust accrual calculations based on their contracted hours or work schedule.

- Carryover: Decide if unused leave balances can be carried over to the next year.

- Cash-out: Establish policy on whether unused leave can be cashed out upon termination or other circumstances.

Few scenarios for accrual calculations:

Example 1:

➤ An employee is granted 8 hours of leave per month

➤ Total amount of leave hours per year will be 96 hours

➤ The employee uses only 40 hours of leaves in a year

➤ They will be left with a balance of 56 hours

➤ These accumulated leaves or accruals and are carried forward to the following year

| Year | Leaves earned | Leaves used | Accrued leaves |

|---|---|---|---|

| 2022 | 96 hours | 40 hours | 56 hours |

| 2023 | 96 hours | 0 hours | 152 hours |

Example 2:

➤ Brian get 12 personal days of leaves per year

➤ Leaves accrue on the first of each month

➤ In the first 6 months Brian used 3 days of leaves

➤ This left him with 4 days of leave at the start of July

➤ In August, Brian was promoted and became eligible for an additional 12 days of leaves per year.

➤ This brought his total annual leave entitlement to 24 days

➤ If Brian does not take any more leave for the rest of the year, he will have 14 days of leave available at the end of December. This is calculated as follows:

- 4 days of accrued leave from January to July

- 10 days of accrued leave from August to December (2 days per month)

By implementing a well-defined leave accrual system, employers can ensure their employees’ fair and transparent compensation, minimizing payroll errors, and boosting employee satisfaction.