What is Expense Tracking?

Expense tracking is the process of recording and monitoring all of your business expenses. This includes tracking all costs incurred by your employees and employers for overall business operations.

Some examples of business expenses include labor costs, material costs, employee salaries, office supplies, and utilities.

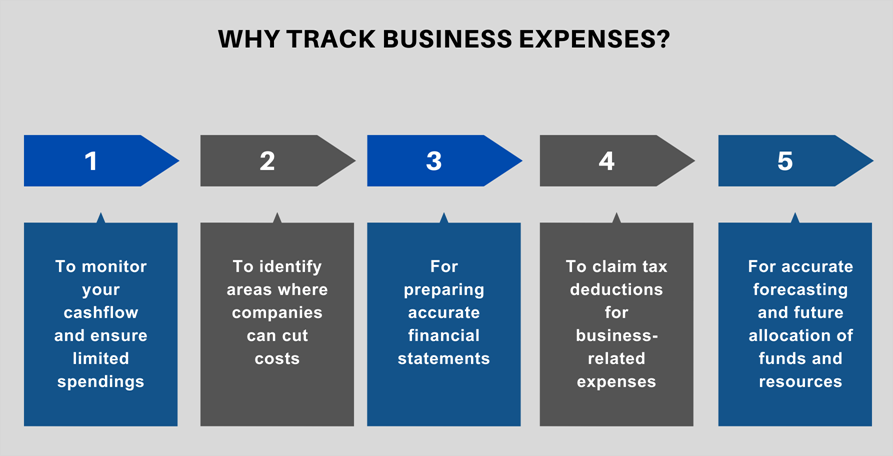

Why is it important to track business expenses?

-

To monitor your cashflow and ensure limited spending. By tracking your expenses, you can see where your money is going and make sure that you are not overspending in any one area.

This can help you to stay on budget and avoid running out of cash.

-

To identify areas where the company can cut costs. By tracking your expenses, you can identify areas where you could be saving money. For example, you might be able to negotiate lower prices with suppliers or find ways to reduce your energy consumption.

This can help you to improve your bottom line and make your business more profitable.

-

For preparing accurate financial statements. Accurate financial statements are essential for businesses of all sizes. They provide a snapshot of your company’s financial health and can be used to make important decisions about things like financing, investments, and growth.

By tracking your expenses, you can ensure that your financial statements are accurate and up-to-date.

- To claim tax deductions for business-related expenses. Many business expenses are tax-deductible, which can save you money on your taxes. By tracking your expenses, you can keep track of which expenses are deductible and claim them on your tax return.

-

For accurate forecasting and future allocations of funds and resources . By tracking your expenses, you can get a better understanding of your company’s spending habits. This information can be used to forecast future expenses and allocate funds and resources accordingly.

This can help you to avoid surprises and ensure that your business has the resources it needs to grow and succeed.

How to track Business Expenses?

There are several ways to track business expenses. You can use a manual system, such as a spreadsheet or a software program, for tracking business expenses. If you use a manual system, it is important to be organized and keep accurate records. Several options are available if you choose to use a software program, including QuickBooks, FreshBooks, OfficeClip, and Expensify.

How expense tracking helps businesses?

- Proper usage of funds: By tracking your expenses, you can see where your money is going and ensure it is used most efficiently.

- Manage reimbursements to employees: If you reimburse employees for business expenses, tracking expenses can help you to ensure that the reimbursements are accurate and that the employees are not submitting fraudulent claims.

- Planning future estimations: By tracking your expenses over time, you can better understand your business’s financial needs and make more accurate projections for the future.

- Reduce tax burden by categorizing expenses: By tracking and categorizing your expenses correctly, you can take advantage of tax deductions and credits to save your business money.